Life Insurance Strategies for Business Owners

Owning a business can be like parenting. You’ve likely experienced many sleepless nights and spent a countless amount of energy on your “baby.” Like parenting, being a business owner can be an enriching journey and make life worth the trip.

From Tax Efficiency to Retirement: Financial Planning for Small Business Owners

Financial planning for a small business gets more complicated every day. Business owners must navigate tax efficiency (and life under the new Tax Cuts and Jobs Act), retirement preparations for yourself and your employees, and succession planning. Get your financial plan in place today and …

8 Financial Planning Tips for Small Business Owners

Running a small business involves juggling multiple responsibilities. Managing the business’s finances is one of the most crucial aspects. Proper financial management can be the difference between a thriving business and one that struggles to stay afloat. Here are eight essential financial …

The Corporate Transparency Act: What You Need to Know

By Mike Valenti, CPA, CFP®, Director,Tax Planning LLCs can provide legal protections and a level of anonymity, either or both of which can be beneficial for business owners, investors, and others with valid intentions. But those features also attract criminal activity, and layers of shell c …

Life Insurance for Business and Estate Planning

By Matt Lewis, CLTC, Vice President, Insurance Life insurance is designed to provide for your loved ones after your death, giving you peace of mind that their financial needs will be met without your income. But life insurance can benefit your financial planning in many other ways.

Building Your Ideal Business Succession Plan

By Odaro Aisueni, CFP®, Wealth Planning Administrator As a small business owner, you’re likely so immersed in the routine functions of your business that you haven’t yet put much thought into the day you leave it behind. In fact, most small business owners have so much purpose t …

Succession Planning for Your Business

The hit show Succession on HBO has shown all business owners the importance of having a succession plan. Although the company started by the Roy family, Waystar Royco, is a multi-billion dollar company, many of the challenges faced by them as a business and a family is things that n …

5 Common Business Exit Planning Mistakes (and How to Avoid Them)

By Elizabeth Schanou, JD, CExPTM , Senior Wealth Planner Succession planning – or more accurately “business exit planning” – is a critical process that has weighty implications for small business owners. There are two key goals: You want to ensure a seamless transition that will pres …

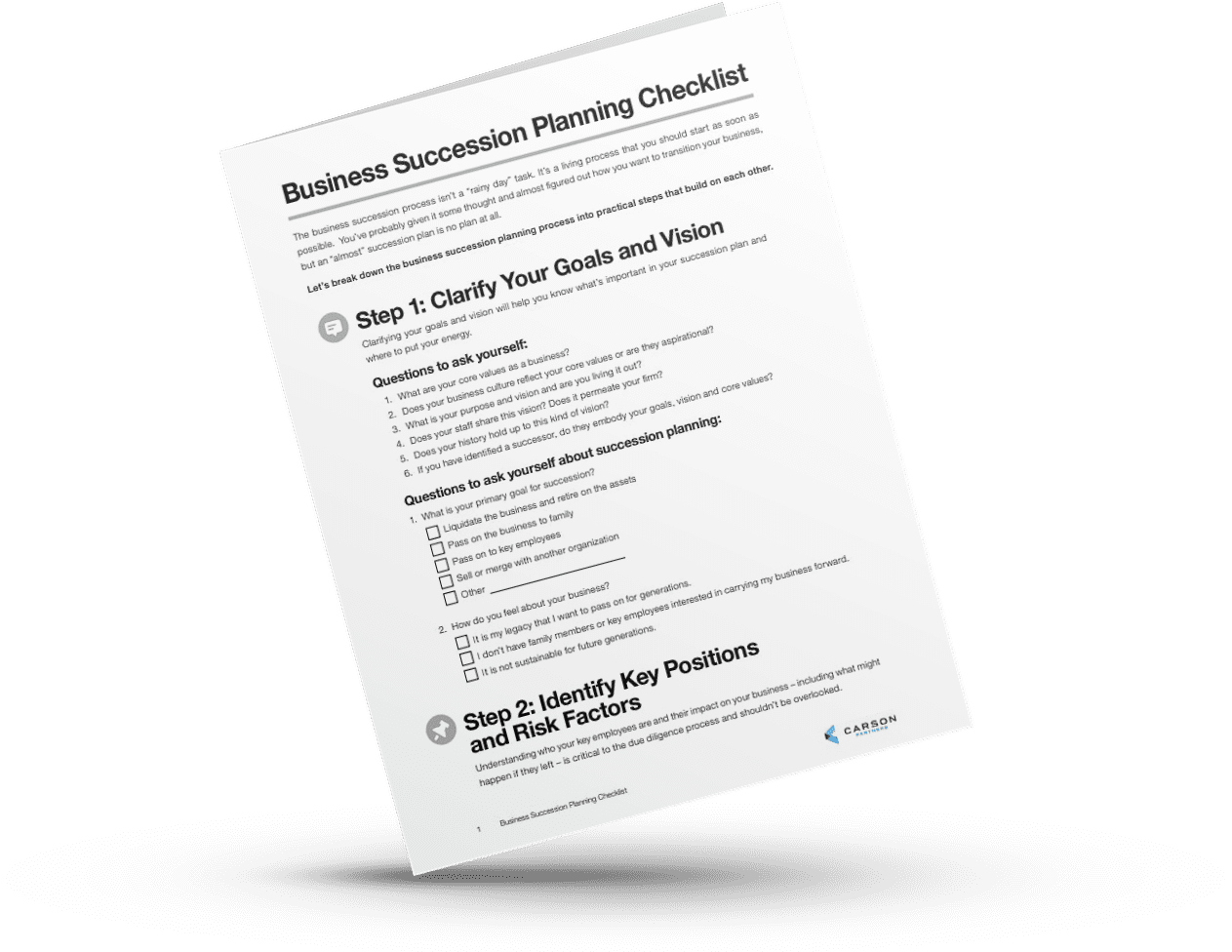

Business Succession Planning Checklist

The business succession process isn’t a “rainy day” task. It’s a living process that you should start as soon as possible. You’ve probably given it some thought and almost figured out how you want to transition your business, but an “almost” succession plan is no plan at all. Fill in the f …

Understanding Cash Balance Plans

Business owners need to understand what cash balance plans are and how they work. These types of plans are becoming increasingly popular among business owners who want to provide both themselves and their employees with a steady stream of income in retirement and provide the business with …

COMPLIMENTARY RESOURCE

Business Succession Planning Checklist

You remember your first day of business. But what about your last day? Succession planning is more complex than it may seem. Our guide walks you through the details.