Why Estate Planning Matters for Everyone

Estate planning may feel like something you don’t have to worry about quite yet. The truth is that ample planning now can make everything easier for your loved ones when the time comes to put an estate plan into action.

Estate Planning Checklist

No matter how few your assets or how extensive your properties, an estate plan will help you preserve your legacy and provide clarity to your surviving family. Our estate planning checklist can help you start the process and tick those important boxes on your way to confidence about the fut …

Why Do I Need a Will? Everything You Need to Know

By Beth Schanou, JD, CExP, Senior Wealth Planner Who wants to spend an afternoon thinking about their mortality? No one, which is why more than half of Americans don’t even have a will.

Life Insurance for Business and Estate Planning

By Matt Lewis, CLTC, Vice President, Insurance Life insurance is designed to provide for your loved ones after your death, giving you peace of mind that their financial needs will be met without your income. But life insurance can benefit your financial planning in many other ways.

Life Goals: Understanding Life Insurance and How it Fits in Your Finances

Watch our webinar, “Life Goals: Understanding Life Insurance and How It Fits in Your Finances” with Carson Group’s Vice President, Insurance Matt Lewis, now available on-demand.

Exit Strategies for Business Owners

Watch our webinar, “Exit Strategies for Business Owners” with Carson Group’s Director, Wealth Planning Kimberly Flynn and Mark Petersen, Vice President of Affluent Wealth Planning, now available on-demand.

Succession Planning for Your Business

The hit show Succession on HBO has shown all business owners the importance of having a succession plan. Although the company started by the Roy family, Waystar Royco, is a multi-billion dollar company, many of the challenges faced by them as a business and a family is things that n …

Financial Literacy Guide

The basics of financial literacy – such as budgeting, borrowing and saving – can be difficult to teach to kids, but the rewards of a child heading into adulthood with a solid understanding of financial literacy are numerous. Download the checklist today to get started.

Kids & Money- Empowering The Next Generation

Financial literacy for the next generation is so important and something I have heard discussed since I entered the profession. Many have talked about the lack of financial education in the schools and things have gotten better but not to the point where our kids are receiving the e …

Charitable Giving Strategies in a High-Income Year

Tom Fridrich, JD, CLUⓇ, ChFCⓇ, Senior Wealth Planner The end of the year offers an ideal opportunity to look both forward and back — reflecting on recent achievements, while setting goals for the upcoming months. For many of my clients, it’s also a time to review their finances and i …

3 Nontraditional Ways to Give That Still Qualify for a Tax Deduction

Kevin Oleszewski, Senior Wealth Planner ‘Tis the season to give. In fact, 37% of charitable giving occurs during the last quarter of the year — 20% of it in December alone, according to a survey conducted by the Blackbaud Institute. And while the holidays are traditionally a time to reflect …

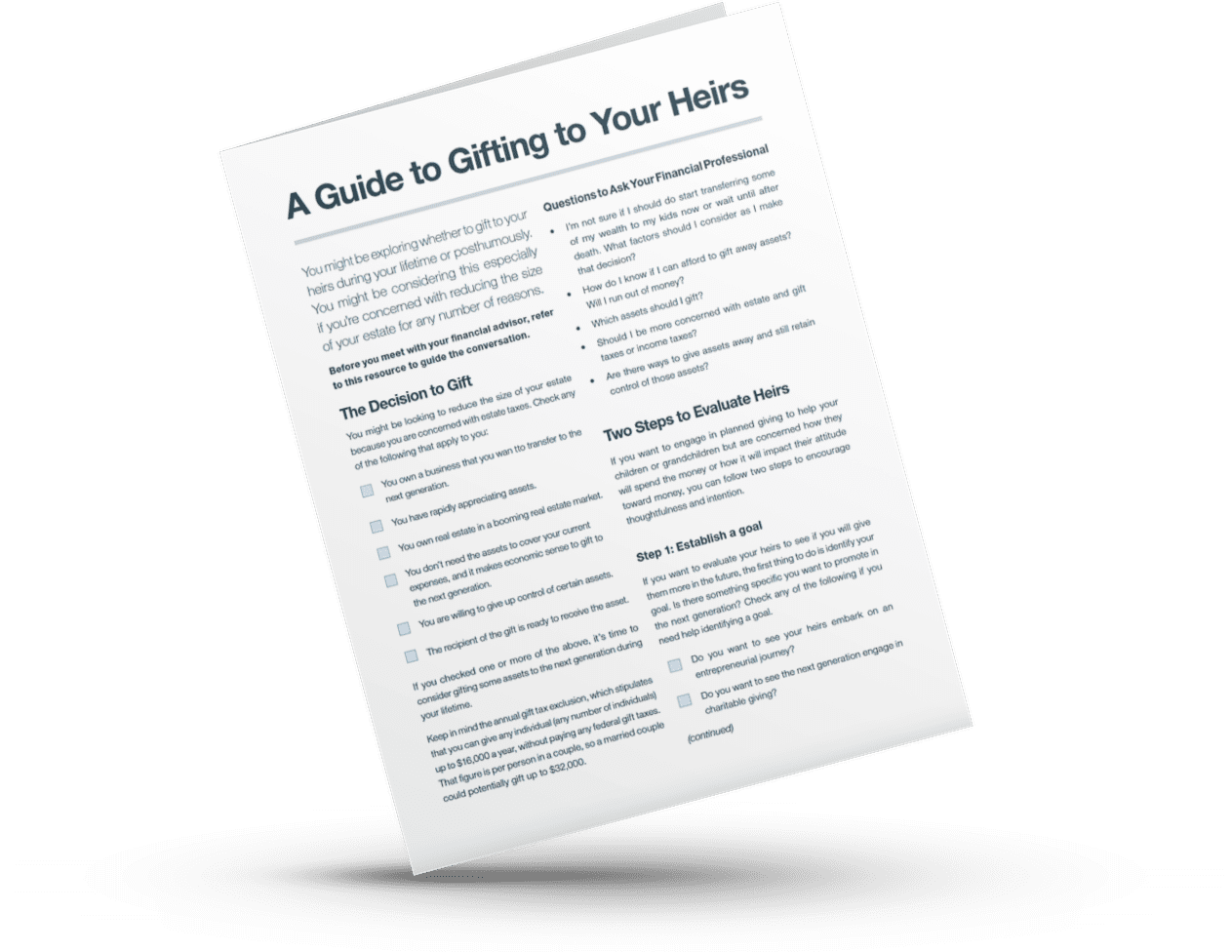

COMPLIMENTARY RESOURCE

A Guide to Gifting to Your Heirs

Gifting to your loved ones now or posthumously each carries their own positives and negatives as they relate to your estate plan, taxes, your goals and your legacy.