Events are aligning to give the U.S. economy a big boost. The Biden administration approved a $1.9 trillion stimulus package that will provide immediate relief to millions of American households. Last week the U.S. surpassed 100 million vaccine doses, and expectations are the U.S. will be vaccinating all age ranges by mid-late April.

Key Points for the Week

- President Biden signed the $1.9 trillion stimulus package approved by the Senate two weeks ago. The package funds $1,400 checks being sent to much of America.

- More than 100 million vaccine doses have been administered in the U.S., providing a source of additional economic demand.

- The recovery continued to support the job market as initial unemployment claims fell and job openings increased.

The benefits of reopening are already showing up in the U.S. economy. Initial unemployment claims have fallen in recent weeks as has the number of people receiving unemployment benefits. Employers are posting more jobs to meet an expected increase in demand. Concerns the improving economy will spur inflation received little support from Consumer Price Index (CPI) data.

Stock markets welcomed the improving economic outlook. Last week, the S&P 500 climbed 2.7% and posted its best week since November. The MSCI ACWI index rallied 2.6%. The Bloomberg BarCap Aggregate Bond Index was basically unchanged even though the 10-year Treasury bond yield reached its highest level in the last year.

China returns to reporting numbers after the country’s New Year holiday break. The world’s second largest economy will report industrial production and retail sales, and the U.S. will report the same data points. The Federal Reserve meets this week, with little to no change expected. U.S. productivity will be forced to contend with March Madness and the effort normally productive workers spend trying to win the $100 office pool.

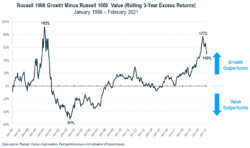

Figure 1

Is the Economic Daylight Saving Value?

Daylight savings arrived for most of the U.S. this weekend. The extra evening daylight means we get a bit more time to enjoy a trip to the range, an evening walk, or even a night out at a restaurant. The extra hour adds a boost to activity levels that are already on the rise as COVID numbers continue to fall and restrictions loosen in many states.

As activities resume, the economy will continue to improve, and that shift is being reflected in the markets. Value stocks have been gaining ground on growth stocks recently. Since November 6, 2020, value stocks have risen 18.1% compared to growth stocks, which have risen 11.3%. Prior to that date, value stocks had trailed growth stocks, lagging by 39.4% in 2020.

Why the big swings between the two styles? Prior to the pandemic, growth stocks had been doing very well compared to value. As Figure 1 shows, growth stocks had been outperforming value in the years prior to COVID. The pandemic accelerated that outperformance. Growth stocks are often disruptive, technology-based companies. Those firms were less affected by COVID. Many value stocks rely on human interaction in their businesses and are also reliant on people traveling, going to stores, and generally being on the go.

November 6, 2020, was the Friday before the first successful vaccine trial was announced. The high level of protection offered by the vaccine caused investors to anticipate a broad reopening, and value stocks rallied more than growth stocks. In Figure 1, this rally is shown by the line trending lower. The last time growth outperformed value by this wide a margin, it peaked at 92% and then plummeted as the technology bubble popped and growth stocks sank.

Some investors expect this to happen again, but there is a danger in extrapolating trends or expecting history to repeat itself. While value could swing back to outperforming, three reasons lead us to believe the magnitude won’t be as wide as the value market that peaked in 2003.

- The technology companies in the growth index are profitable businesses with enviable market share.

- The economic growth surge from the vaccine and stimulus will likely fade in coming years. Pent-up demand and large checking account balances are expected to provide a surge of growth in coming years. Yet, the underlying characteristics of the economy point to slow growth as productivity gains haven’t been enough to make up for slowing population growth.

- The pace of disruption is likely to stay high, favoring growth. Innovation is transforming shopping, entertainment, and advertising. The value stocks that do the best may be those incumbent firms able to pivot toward new business models.

Diversifying your portfolio is extra-prudent in periods like this. If value rallies even more, you might feel some regret in the same way that a resurgent growth rally can produce the same emotion. Sometimes accepting a difficult situation and spreading out your risk is the best thing you can do. That way, if you lose sleep this week, it will be because it gets dark so late and not because worrying about your portfolio is keeping you up.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds

https://www.cnbc.com/2021/03/11/weekly-jobless-claims.html

https://economy.com/economicview/calendar/week?indicators=off&month=32021

https://www.statista.com/statistics/269857/most-profitable-companies-worldwide/

Compliance Case #00979803