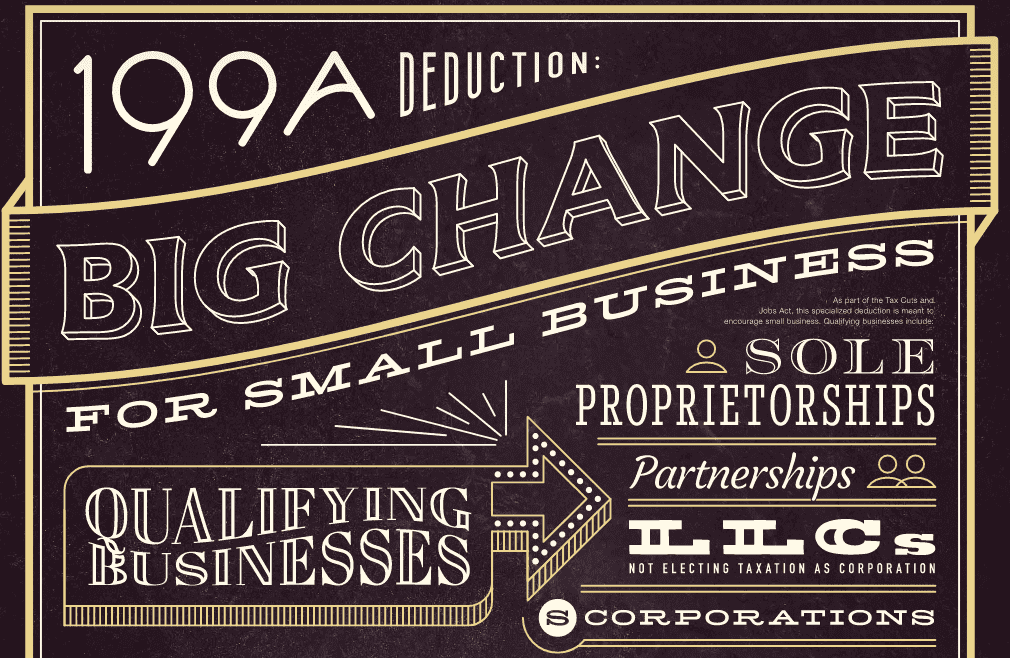

199A Deduction – Big Change for Small Business Owners

Two-hundred-forty-seven pages later, we have one large IRS document and a whole lot of questions. For small business owners, 199A deductions are complex. Do you fall into the 95 percent of small business owners covered? When do 199A deductions expire? What are the income ranges? Learn more about 199A deductions and how you might be affected in our infographic.