Special Update

The first COVID-19 vaccine to announce results reported very positive data early Monday morning. Two notable pharmaceutical and biotech companies announced on Monday their COVID-19 vaccine was more than 90% effective. The study also showed there were no side effects observed in the vaccine trial. The effectiveness is higher than many medical experts expected and represents a major step forward in efforts to contain the virus. News on other vaccine trials is expected in coming weeks and months.

The news boosted markets sharply at the time of writing. The news will likely affect companies quite differently. The initial reaction was most positive for companies relying on higher levels of human interaction. Companies that have benefited from higher usage during the pandemic may experience the opposite reaction.

Despite tremendous uncertainty about the outcome of the U.S. election, U.S. stocks soared last week. The election turned out to be closer than polls indicated, and control of the Senate rests on the outcome of two runoff elections in Georgia, which is fueling uncertainty around future tax policy.

Key Points for the Week

- Political angst over a close election and prolonged vote counting didn’t stop the S&P 500 from soaring 7.4%.

- The U.S. added 638,000 jobs in October and the unemployment rate dipped to 6.9%.

- Corporate earnings continue to come in well above expectations.

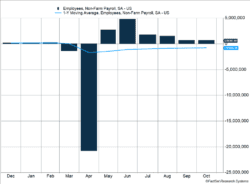

Economic and earnings news showed the underlying strength of the U.S. economy. Non-farm payrolls rose 638,000 last month (Figure 1) and helped push the unemployment rate down to 6.9%. The job gains beat expectations of 530,000. Private sector job gains were even larger, rising 906,000, as the expected reduction in temporary census workers contributed to declining government employment.

With nearly 90% of S&P 500 companies having reported earnings, 86% have beaten expectations. At the beginning of the quarter, S&P 500 earnings were expected to drop 21.2%. Current expectations are for a decline of only 7.5%.

The market reaction to the election confounded expectations of extreme volatility. The S&P 500 gained 7.4% last week and global stocks, represented by the MSCI ACWI Index, jumped 7.6%. The Bloomberg BarCap U.S. Aggregate Bond Index added 0.5%.

Figure 1

Surprise! Surprise! Surprise!

Last week would surely have caused Gomer Pyle to shout “Surprise! Surprise! Surprise!” as stocks continued to rise in the face of a momentous election and political uncertainty. Pyle was a character on The Andy Griffith Show who was hopelessly naïve and awestruck by the simplest things. But last week’s performance was a surprise even to the most skeptical market watchers — and a remarkable reminder of how difficult it is to pick the right times to move in and out of stocks.

The U.S. election was far closer than expected. Protests were lodged and recounts demanded. Control of the U.S. Senate will likely not be known until January. The market response: It soared. It is easy to imagine an investor who pulled out of the market grumbling, “Everything I was worried about happened, and the S&P 500 rose 7.4%!”

How can the market increase when so many factors are going against it? Firstly, companies are being valued based on their ability to earn profits and increase the value of the underlying business. Almost 90% of the S&P 500 has announced earnings for the third quarter, and those earnings are far better than expected. Fully 86% of companies that have announced earnings have beaten the average analyst expectations, even up to an incredible 19.5%. So many companies beating by such a wide margin has moved the expected earnings change from -21.2% to -7.5%.

Secondly, the economy is showing greater resilience even though the number of new COVID-19 cases is growing. October’s employment report showed non-farm payrolls rose by 638,000, beating expectations of 580,000 (Figure 1). The underlying data indicated broad strength. Private payrolls rose 906,000 as government employment dropped when temporary census workers finished their work.

Many unemployed people are expected to return to their previous jobs as workers continue to be rehired. Permanent job losses, which have climbed steadily during the slowdown, reversed course and fell 72,000. Unemployment dropped to 6.9% and the number of people working or looking for work expanded to 61.7% of eligible workers.

Finally, people’s expectations of how their neighbors would behave in a close election proved to be pessimistic. The election was tight, and it took days to proclaim a winner. Certain appeals may still be made. But, most importantly, the system functioned well enough that people aren’t transferring political concerns over to their portfolios. As we have stated several times in this update, politics are not as important to investors as earnings and the economy.

The pessimistic expectations investors hold are a perverse example of overconfidence. Some investors who are worried about political unrest expect other investors to overreact. They hope to get out of the market and swoop in for bargains when the market declines. They assume they can perceive the market risk and intuit the reaction of other investors. Both are difficult to do, and the cost of getting it wrong, as this week showed, can be high. Being naïve can leave you surprised, but being overconfident can sometimes cost you even more.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds

https://en.wikipedia.org/wiki/Gomer_Pyle

https://www.bls.gov/news.release/empsit.nr0.htm

https://www.cnbc.com/2020/11/06/jobs-report-october-2020.html

https://insight.factset.com/sp-500-earnings-season-update-november-6-2020

Compliance Case: 00904536